What Problems Does Weel Solve

What Problems Does Weel Solve

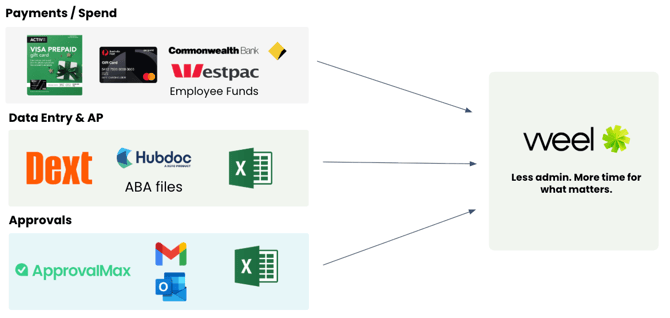

At its core, Weel replaces messy, manual financial processes with a single, automated system for cards, subscriptions, reimbursements, approvals, and accounts payable.

Most businesses, and the partners who support them, reach a point where their finance workflows simply don’t scale. Manual processes start creating inefficiency, compliance risk, and frustration for everyone involved.

Weel helps by simplifying spend management into one platform that’s fast, accurate, and compliant - saving time for clients and partners alike.

Common Challenges we hear from Customers & Partners

Below are the recurring problems we hear most often:

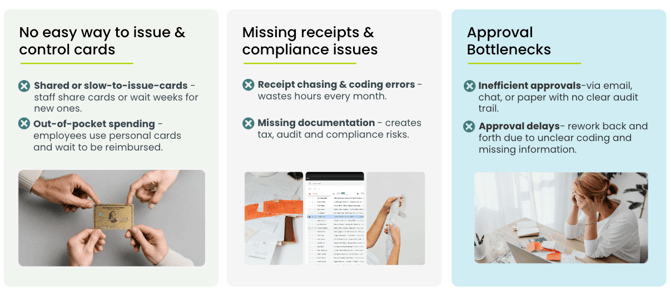

1. Operational Inefficiencies

These are the day-to-day friction points that cost both partners and clients time.

-

Shared or limited corporate cards: Multiple team members using shared cards, making it unclear who spent what.

-

Hard to get new cards from the bank: Lengthy approval processes and paperwork to issue or cancel cards.

-

Slow reimbursements: Employees wait weeks to be repaid for out-of-pocket expenses.

-

Scattered approvals: Approvals buried in email threads or messages with no visibility or audit trail.

-

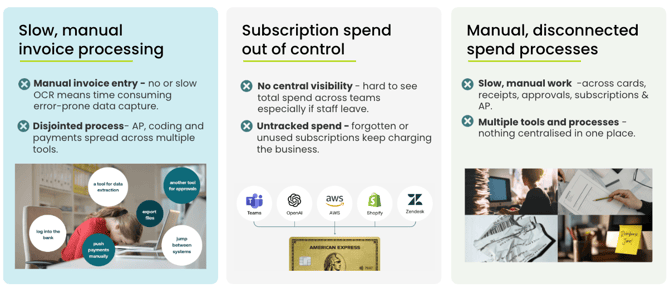

Manual invoice processing: Supplier bills re-keyed and paid manually.

-

Tool sprawl: Clients juggling multiple systems like Dext, ApprovalMax, Xero, and email to complete one workflow.

-

Time lost chasing receipts, matching transactions, or cleaning up coding errors.

2. Compliance, Control & Risk Problems

Manual systems aren’t just inefficient - they’re risky.

-

Fraud exposure: Shared cards, petty cash, or lack of controls increase the chance of misuse or unauthorised spend.

-

Missing audit trails: Unclear approval chains make it hard to prove compliance or satisfy auditors.

-

Weak spend controls: Budgets exist, but there’s no enforcement or visibility into who is spending what.

-

Petty cash management: Physical cash or untracked gift cards lead to missing receipts and untraceable spend, creating reconciliation headaches.

3. Growth & Scale Problems

What worked when the business was small starts breaking down as they grow.

-

Maverick spending: Purchases made outside policy or without approval.

-

Duplicate or unused subscriptions: Ongoing SaaS or service charges that go unnoticed.

-

Decentralised purchasing: Different sites or departments spending independently with no oversight.

-

Month-end crunch: Too much time spent chasing receipts or approvals, delaying reporting and decision-making.

These problems cost both sides time and accuracy - the client loses visibility and control, and you (the partner) end up chasing, cleaning, or reconciling data that should be automated.

How these problems show up in practice

You might recognise

- Rework caused by incorrect coding or manual errors that delay month-end.

-

Chasing clients for receipts, approvals, or missing invoice details.

-

Reconciling shared cards and manually processing reimbursements.

-

Following up repeatedly for approvals or details before closing the books.

-

Delayed month-end or audit preparation.

- A sense that finance admin is 'never-ending'.

- Near misses or incidents of unauthorised or fraudulent spend.

When these issues come up, it’s a strong indicator that the business has outgrown its manual financial systems and needs a better process for control, compliance, and efficiency.

Where Weel Comes In

Your clients are often ready for Weel when they are experiencing a few of the above problems and:

- Are ready to move away from shared cards, petty cash, or manual reimbursements.

- Looking for better visibility and control across their spend.

- Want to work more efficiently with their accounting and bookkeeping partner.

Weel automates the manual work, enforces controls, and provides real-time visibility -giving both clients and partners time back, cleaner data, and confidence that their finance systems can scale.