Understanding Weel Plans

As a Weel Referral partner, you don’t need to sell or explain every feature - your role is simply to spot opportunities and introduce clients who are a good fit.

You don’t need to recommend a specific plan - but it's helpful to understand the differences. Once you make the introduction, the Weel team will help your client choose the plan that fits best.

How the Plans Differ

Weel offers two plans to suit how your clients work. Basic simplifies core finance admin for small teams, while Premium adds advanced automation and controls for clients with more moving parts.

|

Weel Basic |

Weel Premium |

Perfect for:

Suits clients who:

|

Perfect for:

Suits clients who:

|

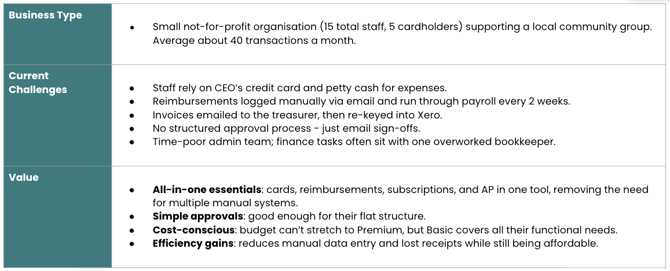

Customer Example - Basic Plan

Here’s what a typical Weel Basic client looks like - smaller teams with simple approvals who are ready to move away from shared cards, petty cash, and manual reimbursements.

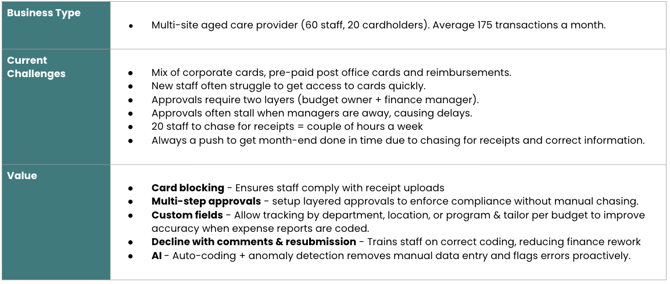

Customer Example - Premium Plan

A Weel Premium client usually has more complexity - multiple approvers, higher transaction volumes, and growing admin demands that make manual processes unsustainable.

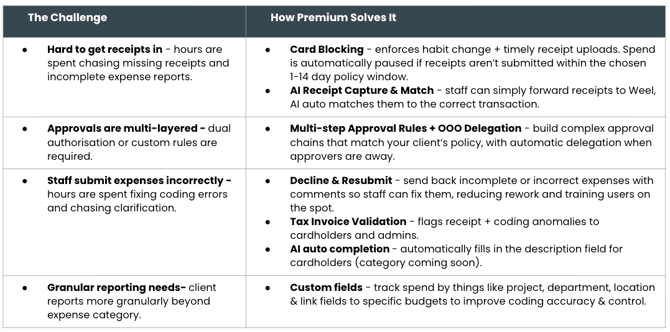

Premium Features

Weel Premium is designed to eliminate repetitive finance admin and enforce good financial habits automatically. These examples show how Premium features remove common pain points for larger or more complex teams.

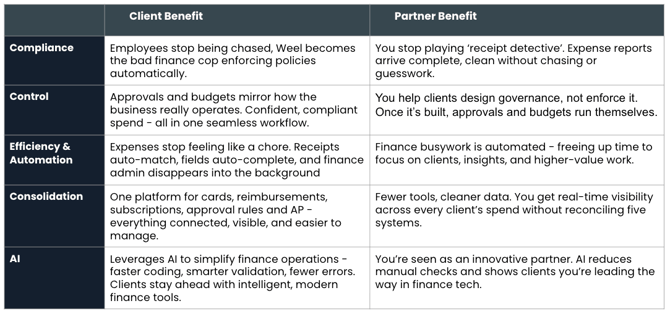

Premium doesn’t just make finance easier for your client - it makes collaboration with you smoother too. Here’s how both sides benefit when manual work disappears.

Premium isn’t just for large teams

The average Premium customer has 19 active Weel users, and over a third have fewer than 10. Even small teams choose Premium when their finance pain is high - chasing receipts, fixing errors, or managing multi-step approvals.

With Premium:

- Card blocking, AI Receipt Validation, AI Auto Field Completion & Email-in receipts mean you’re not chasing clients for missing receipts or incomplete reports.

- Custom approval rules and custom fields mirror how your clients already work but bring workflows into one consolidated place.

- Less chasing, more control, faster month-end close

And the cost?

At a starting rate of $375/month, that’s less than $95/week - about 2–3 hours of finance admin time.

If Premium saves even a few hours a week chasing receipts, approvals, or fixing errors, it pays for itself - while giving you time back to focus on higher value work.